FREQUENTLY ASKED QUESTIONS

ABOUT MY LOAN

Making an application is quick and easy – you just need to have the following documents ready to give your broker:

- Current Australian Residency Identification

- 2 recent payslips

- Or one current bank statement

In short the answer is No, you can source your own car. We offer a holistic solution to our customers, from financing to sourcing a vehicle at the most competitive rates and specs that suits you through our vehicle solutions partner – Drive.

We are a multi award winning independent finance group who believe in helping people achieve their dream or goal with our holistic solution we compare 40+ Lenders. Arranging everything from finding the right finance at the best low interest rate and a no deposit that suits you to sourcing the right vehicle – finding the right vehicle, that suits you, through our vehicle solutions partner – Drive

Interest rates can vary depending on the age of the vehicle you are buying, your credit file, credit score, assets and liabilities. Our rates start as low as 4.69%* for new vehicles for business use customers.

* based on a commercial contract for a new vehicle with specific criteria.

A balloon payment allows you to reduce your repayments during the term of the car loan by making a once-off lump sum payment at the end of your loan. For example, if you were to take a $30,000 loan over five years with a 30% balloon, your regular repayments at a comparison rate of 8.10% would drop from $609.73 per month to $467.24 per month with the addition of a $9,000 lump sum payment due with your final payment.

Balloon payments are available for cars that are up to five years of age. We will contact you within the last six months of your loan term to discuss your payment options. Your payment options could include re-financing the balloon amount in a new car loan. Alternatively, you could pay this balloon payment from your own funds.

APPLICATION AND APPROVAL

Once we receive your online application, you will be contacted by one of our experienced brokers, within 2 business hours. The timeframe from our high approval rate to completion can be anything from 1 hour under ideal circumstances. Give us a call on an obligation free discussion with one of our experienced brokers. to walk you through our fast and easy approval process

If you apply for finance with 1800 Approved as an ABN customer you can:

- Apply with less documentation,

- Receive discounted interest rates between 0.4 - 3% less than a consumer loan.

- Benefit from a tax write off with your finance– we recommend speaking to your financial advisor before you apply.

Not if you are currently in bankruptcy or a Part 9 or 10 debt agreement. However, if you are discharged we can be able to assist you. Click here for assessment that will not damage your credit score or call on 1800 2777 6899 and talk to one of our experienced brokers to find a solution. Alternatively

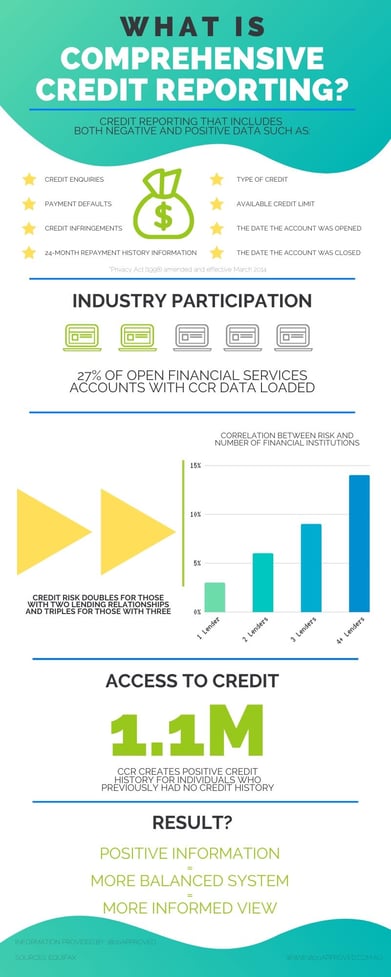

QUESTIONs ABOUT MY CREDIT

The short answer is yes, if your repayments are 14 days overdue or more then this will most likely be recorded on your credit score. At 1800 Approved we believe that everyone deserves an opportunity, so give us a call on 1800 2777 6899 an obligation free discussion with one of our experienced brokers. Alternatively, To learn more download our E-book

At 1800Approved we believe in assessing your circumstances today and finding a solution that best suits you. We do this with the help of our 40+ lender portfolio, so give us a call on 1800 2777 6899 and talk to one of our experienced brokers to find a solution. Alternatively click here for assessment that will not damage your credit score.

At 1800 Approved, unlike a bank, we will not show on your credit file as a “declined” if your application is unsuccessful. We do not leave an impressions on your file as part of our assessment. More than 6 enquiries in a 12-month period may affect your application for finance.

.jpg?width=390&name=your%20credit%20score%20and%20you%20(1).jpg)

Google

Google